- Global Market

- Posted on December 23, 2024

6 Key Factors That Affect Gold Prices Globally

Gold prices are not random; they are driven by a complex interplay of global economic forces. Understanding the factors that affect gold prices can help you make smarter investment or purchasing decisions, whether you are buying for a wedding or a long-term portfolio.

1. Global Economic Uncertainty and Safe-Haven Demand

One of the most consistent factors that affect gold prices is the state of the global economy. When markets become volatile or a recession looms, investors treat gold as a “safe haven.” Unlike paper currencies or stocks, gold has no counterparty risk and has historically maintained its value during financial crises.

2. How Inflation and Interest Rates Work as Factors That Affect Gold Prices

Gold is a classic hedge against inflation. When the cost of living rises and the purchasing power of paper money falls, gold demand typically spikes. However, interest rates also play a vital role. When central banks—like the U.S. Federal Reserve—raise interest rates, gold can lose some appeal because it doesn’t pay a yield. Conversely, low-interest-rate environments are often very bullish for gold.

3. Currency Movements: Economic Factors That Affect Gold Prices

Because gold is primarily denominated in U.S. Dollars (USD) on the international market, currency fluctuations are major factors that affect gold prices. Typically, there is an inverse relationship: a weaker dollar makes gold cheaper for foreign investors, which drives up demand and price. A strong dollar often keeps gold prices more controlled.

4. Central Bank Reserves and Strategic Buying

Central banks are among the largest holders of gold in the world. When these institutions diversify their reserves away from fiat currencies and increase their gold holdings, it signals a lack of confidence in the global monetary system. This large-scale institutional buying creates a strong “floor” for gold prices worldwide.

5. Geopolitical Tensions and Political Risk

Wars, trade disputes, and political instability are immediate factors that affect gold prices. During times of geopolitical conflict, investors flee to assets that are tangible and universally accepted. This “fear trade” often causes gold prices to surge overnight in response to breaking international news.

6. Jewelry Demand and Industrial Factors That Affect Gold Prices

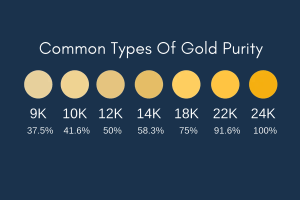

A significant portion of global gold demand comes from the jewelry industry, particularly in emerging markets like India, China, and the UAE. Cultural traditions, wedding seasons, and festivals like Diwali or Eid create predictable seasonal demand. Additionally, gold’s use in medical devices and high-end electronics contributes to its long-term price stability.

Conclusion: Mastering the Factors That Affect Gold Prices

In conclusion, the gold market is influenced by a mix of investor sentiment, monetary policy, and physical demand. By keeping an eye on these factors, you can better understand why rates move and make more informed financial choices. For the latest real-time updates and daily rates, visit Goldrates.com to stay informed on the ever-changing gold landscape.